Xi Jinping shakes investor confidence by targeting China's private sector

SANJEEV SHARMA

| New Delhi

22-September-2021

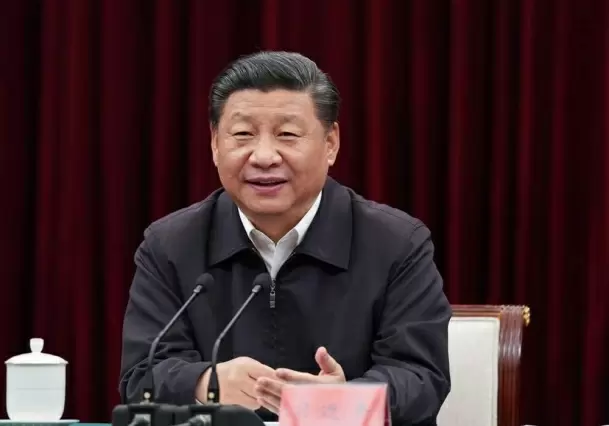

PHOTO: IANS

Chinese President Xi Jinping has shaken investor confidence by painting bulls-eye on industries ranging from e-commerce to ride-sharing to mortgage lending, and targeting the business executives who have benefited from their success.

As Xi has launched a nationwide political campaign built around the Maoist nostrum of "common prosperity" in response to China's deep income inequalities, investors have become nervous about a broad reversal of fortune, Jeremy Mark writes in Atlantic Council.

The Evergrande crisis only underlines their concerns about the prospects for China's property sector, which, ironically, has been the basis for the rise to prosperity that hundreds of millions of Chinese have experienced in recent decades, and negative spillovers to the wider economy.

One key reason that the company is facing collapse is restrictions on home sales and mortgage lending imposed by Beijing to cool a market driven sky-high by years of speculation.

Mark says nonetheless, there clearly is a deep disquiet in Chinese markets in the face of Xi's rapid turn towards strict regulation of the country's most successful private sector companies, which have helped transform China's economy.

Mark adds that many observers worry that the policy movement reflects a profound shift away from the past four decades of support for the private sector, which is China's primary source of employment. The Wall Street Journal reported this week that Xi "appears to want a state in which the party does more to steer flows of money, sets tighter parameters for entrepreneurs and investors and their ability to make profits, and exercises even more control over the economy than now".

Watch This TWL Video

Xi's tectonic shifts, which are now shaking Evergrande, have been creating market tremors for the past year. They began when Xi ordered the cancellation of Ant Group's $34 billion initial public offering (IPO) last November, and that set in motion a rapidly accelerating stream of actions against corporate practices and unseemly profits, Mark said.

Among other steps, the Alibaba Group Holding (Ant's parent) and other e-commerce companies have been hit with heavy fines for anti-competitive practices, the multibillion-dollar private tutoring industry has been banned from turning profits, and online payment companies are facing the prospect of tight government control of their activities as the People's Bank of China moves to issue a digital currency. The tech giants have been strong-armed into donating billions of dollars to government-run social programmes.

The market impact of these policies has been costly. Chinese stocks have shed at least $1 trillion in market capitalisation across the markets in China, Hong Kong, and the United States since the crackdown began.

Alibaba's share price is down 34 per cent this year, and e-commerce and social media giant Tencent Holdings has fallen from the list of world's top 10 companies in terms of market capitalisation. Overall, China's stock markets have been among the worst-performing in Asia this year, Mark said - IANS

More Headlines

Middle Class Should Beware of Budget: Shiv Sena (UBT)

Ayodhya Ram Mandir Chief Priest Acharya Satyendra Das Hospitalised

Erode East Bypoll: DMK Set for Big Win, Survey Shows 59.5% Support

Nil Tax Till Rs 12 Lakh: How Taxpayers Will Benefit From Tax Slab Changes In Budget 2025-26

Budget 2025: Income Tax Exemption Raised to ₹12 Lakh

Middle Class Should Beware of Budget: Shiv Sena (UBT)

Ayodhya Ram Mandir Chief Priest Acharya Satyendra Das Hospitalised

Erode East Bypoll: DMK Set for Big Win, Survey Shows 59.5% Support

Nil Tax Till Rs 12 Lakh: How Taxpayers Will Benefit From Tax Slab Changes In Budget 2025-26

Budget 2025: Income Tax Exemption Raised to ₹12 Lakh